Draven Jackson

Draven Jackson

Blogger | Teacher

Twitter

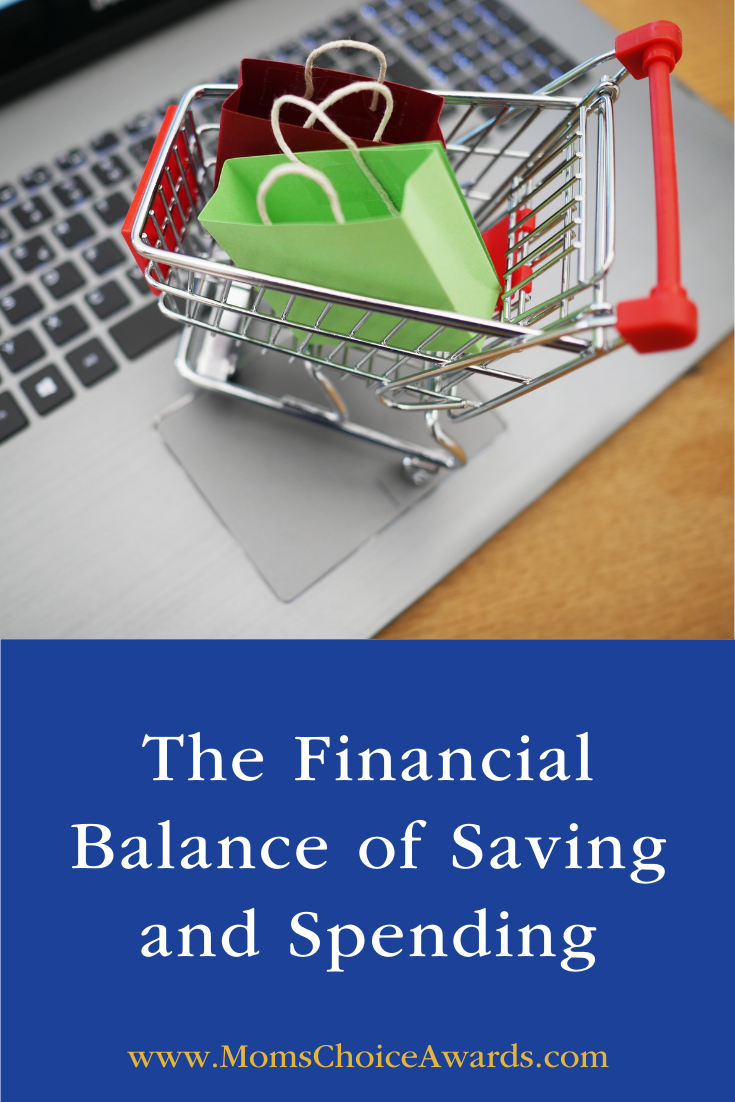

“Money makes the world go round” and round and round and round. Some days, it feels like money – or the lack thereof – is a central struggle in many of our lives. How do we save for our futures, but still enjoy our now? Trying to find a financial balance between saving and spending can be a difficult problem many of us never find the answer to.

Each person has to find their own financial balance, but it’s important to try and find a way to think about tomorrow while still enjoying today. “All work and no play” can make you incredibly unhappy and unsatisfied with your life. Here are some thoughts to consider concerning your finances to help you realize the importance of balancing the two!

It’s Important to Plan for the Future

Having a savings account (or at least a savings budget) is incredibly important for achieving financial balance. While it’s good to treat yourself and have fun with your money, it’s important to remember that you of the tomorrow wants to have fun, too.

Having a savings account (or at least a savings budget) is incredibly important for achieving financial balance. While it’s good to treat yourself and have fun with your money, it’s important to remember that you of the tomorrow wants to have fun, too.

So, if you have the ability to save even the smallest amount, do what you can to create a security blanket for the future you. $20 a paycheck will go a lot farther than you think, and you’ll be thankful to have that extra money set aside in the future.

Consider the problems future you might face: car troubles, doctor’s bills, or school fees. There’s always some unexpected issue waiting around the corner, and sometimes you don’t have the extra money on hand to handle it. However, if you have a savings account or a little bit of excess money saved up, you’ll be more prepared to face those financial struggles.

But You Also Have to Treat Yourself

Saving is incredibly important, but don’t forget that sometimes you also need to treat yourself to a little something special. You work hard for your money! If you only ever work to live and you don’t allow yourself a little moment of fun, then you’re not really appreciating your life. Finding financial balance isn’t just about preparing for the future – it’s also about appreciating the now.

There are so many joys in life that don’t cost anything – the support of your family, the joys of friendship, the beauty of self-love. However, there are also a lot of fun, amazing things that you might cost a pretty penny – that new pair of shoes you’ve been eyeing, a trip to the amusement park, concert tickets, and all the little moments in between.

Don’t limit yourself if you have the opportunity to bring a little bit of pretty joy into your life. It’s not selfish to spend some time and money on yourself – it’s just another form of self-love. And you deserve every penny.

Create a Balanced Budget that Includes “Fun” and “Savings”

For those looking to find financial balance, the first step is creating a budget that includes sections for “fun” and “savings.” I know it seems kind of silly to say, “This is how much I’m allowed to spend on fun plans this month,” especially when you don’t know what those “fun plans” will be.

Setting aside a certain amount of money to be designated as “fun” and “savings” can help you attain a semblance of control over your life. For me, money tends to be one of my biggest stressors. By actively writing down where my money each paycheck will need to go, I’m able to feel a little more in control over the aspects of life that give me stress.

And don’t just create the budget – keep up with it! Buy an accounting book – you can find them cheaply online – and write each expense, from food to bills to fun to savings. Watch how your money moves to help you track the areas where you’re spending too much, or where you have a little wiggle room.

Sometimes it’s good to keep more than one budget book – I like to have a general budget book and then a food budget book. I love to eat – and Tokyo is a foodie’s paradise – and keeping track of how much I spend on food is a must. If there’s an area of your life that costs you more than the others, consider keeping a separate book just to track those expenses.

Teach Your Kids That They Can Have Fun and Save

One important reason to achieve financial balance is so that you can show your kids the importance of thinking about the future while still enjoying the now. If you really want to help them understand, try to encourage them to create their own “budget” with a weekly allowance.

By giving them the opportunity to understand how “finances” work early on, you will greatly help them later in their lives. I can’t begin to tell you how many young people I met in college – and even now, as an adult in the workforce – who have no idea how to budget or balance their finances. They either live too carefully, saving for a future that isn’t here yet, or they spend, spend, spend without a thought for tomorrow.

Showing your children the importance of financial balance gives them the opportunity to understand that it’s okay to treat yourself, but it’s also a good idea to think about the future.

You Only Live One Life – Make It Worth It

At the end of the day, you only live one life. Don’t let money stand in the way of you finding every joy you can in your life. Money can’t buy you complete happiness, but it can bring you little pockets of sunshine that can brighten a bad day.

And if you set aside a savings account and a budget, you give yourself the room necessary to treat yourself to those little joys. When you aren’t worrying about surprise expenses, you can actually enjoy the money you worked so hard to make.

You deserve every happiness the world has to offer. Money can’t keep you from a brighter future.

If you have any other thoughts on achieving financial balance, tell us in the comments!

About Draven Jackson

About Draven Jackson

Draven is an avid writer and reader who enjoys sharing her opinions on movies, books, and music with the rest of the world. She will soon be working as a teacher in Japan and hopes to use her experience to connect with other teachers and students around the globe. Draven spends most of her time at home with her family, her dogs, and her ferret.

To see more, view all posts by Draven Jackson here.

Save

2 Comments on “The Financial Balance of Saving and Spending”

I do also believe in putting a little money aside every paycheck. If you don’t miss it increase it and you can build yourself a little nest egg!

This is a wonderful blog and an eye opener!